This PDF editor was made with the aim of making it as effortless and easy-to-use as possible. All of these actions are going to make managing the california form 568 quick and simple.

Step 1: Find the button "Get Form Here" and then click it.

Step 2: Now you can manage the california form 568. You may use our multifunctional toolbar to insert, delete, and alter the content of the form.

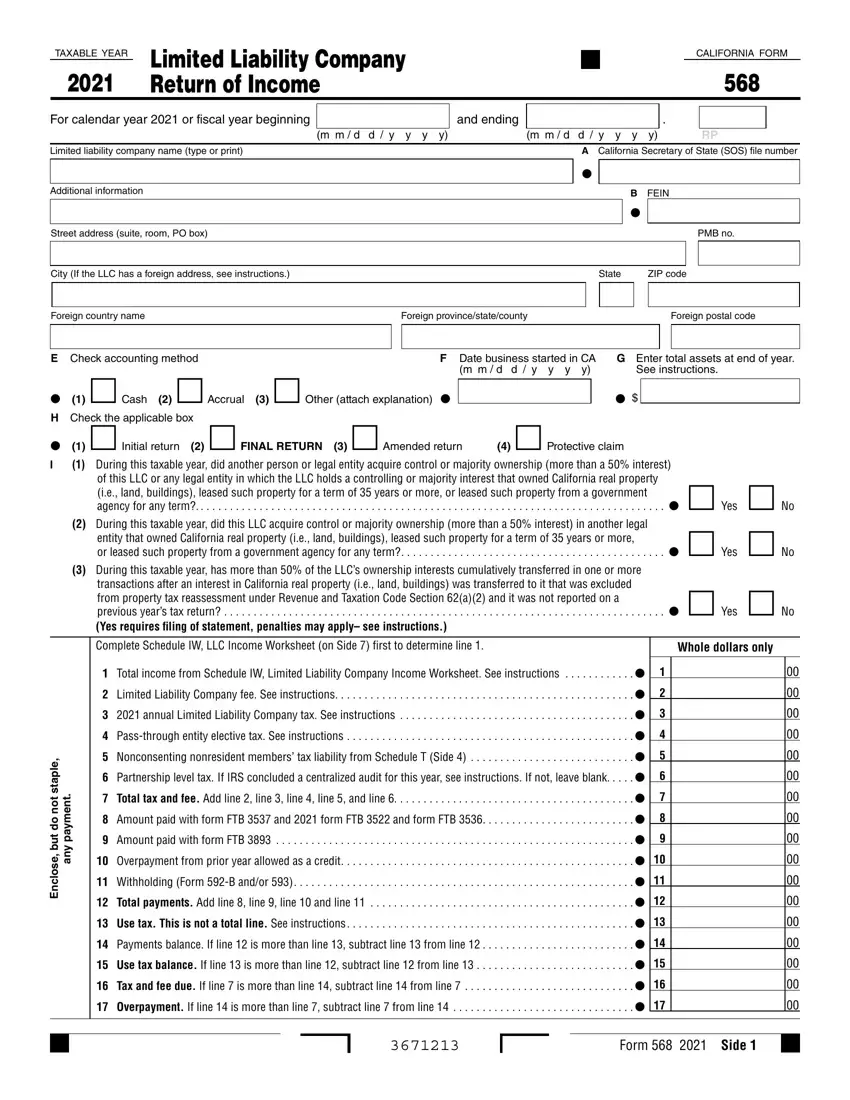

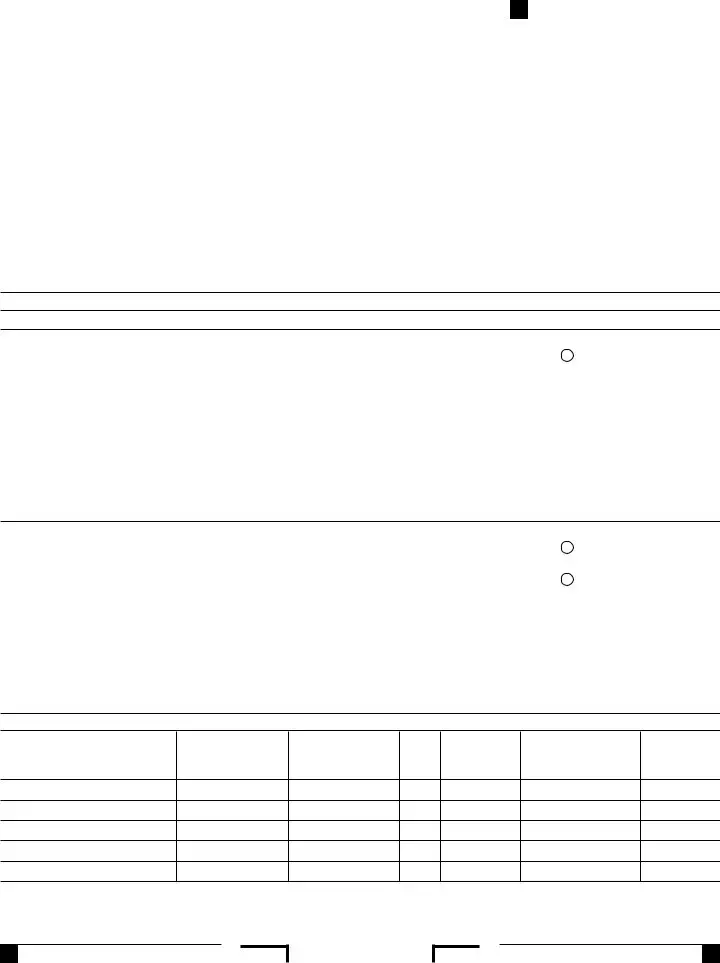

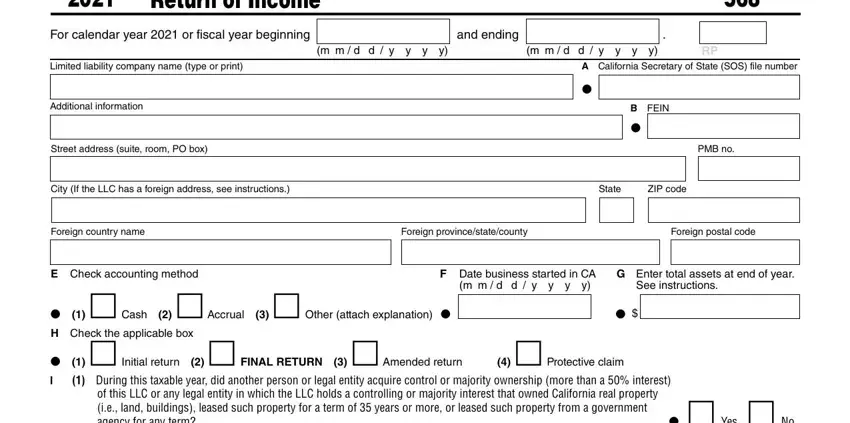

You'll need to enter the next details so you can prepare the document:

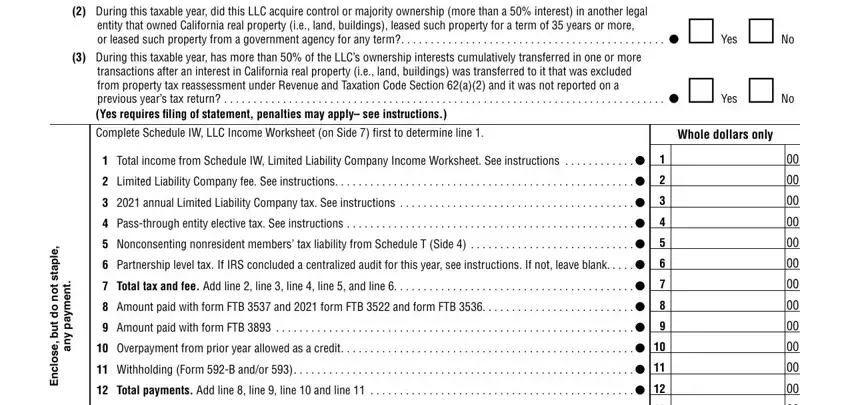

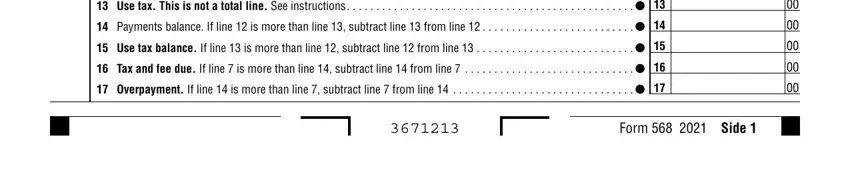

You need to submit the agency for any term, entity that owned California real, During this taxable year did this, During this taxable year has more, transactions after an interest in, previous years tax return, Yes requires filing of statement, Complete Schedule IW LLC Income, Whole dollars only, e p a t s, t o n o d t u b, e s o c n E, t n e m y a p y n a, and Total income from Schedule IW box with the necessary information.

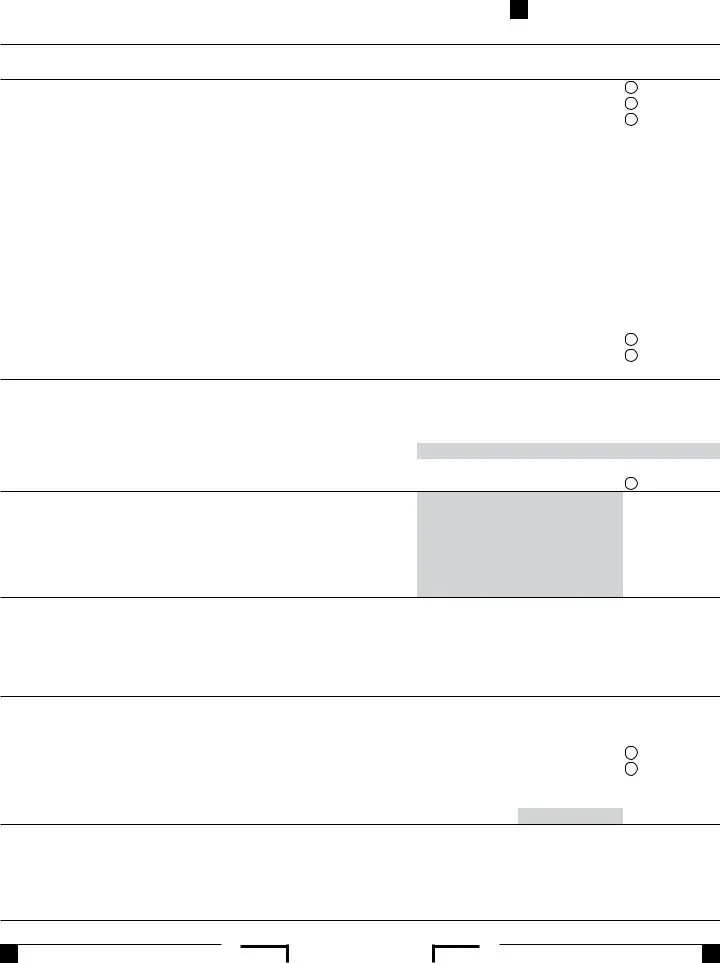

You may be required to enter the information to let the platform complete the field Total income from Schedule IW, and Form Side.

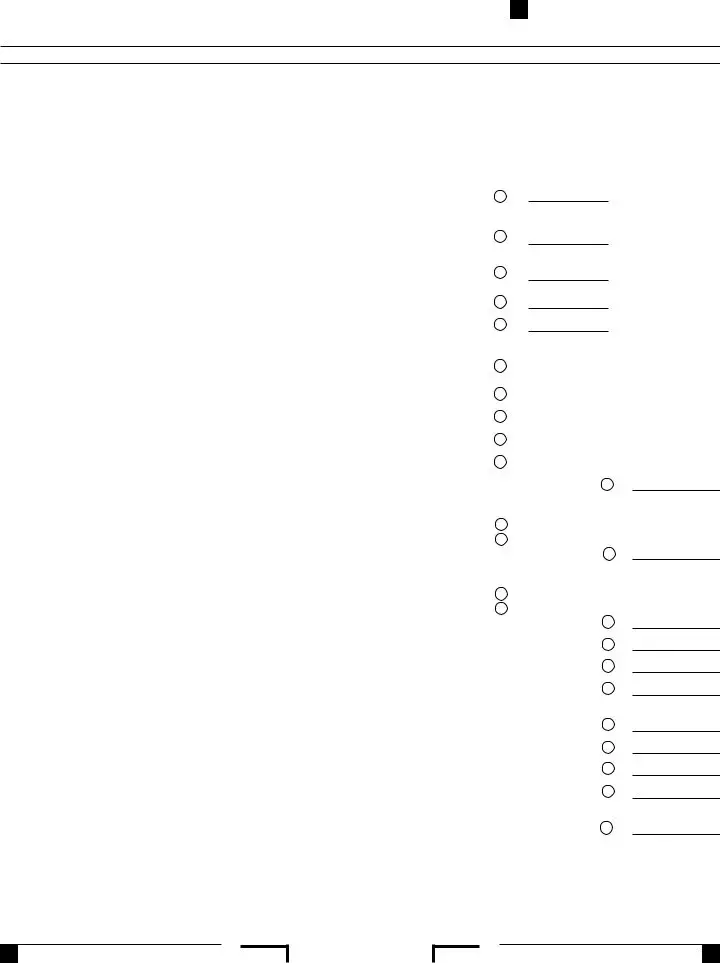

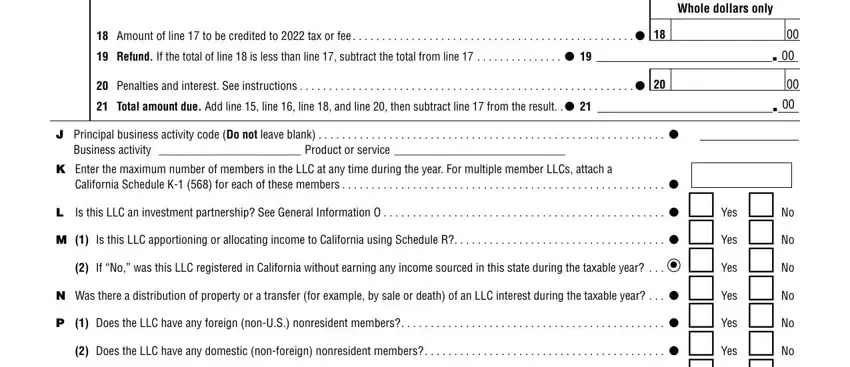

Be sure to include the rights and obligations of the sides in the Amount of line to be credited to, Penalties and interest See, J Principal business activity code, Whole dollars only, K Enter the maximum number of, and California Schedule K for each of section.

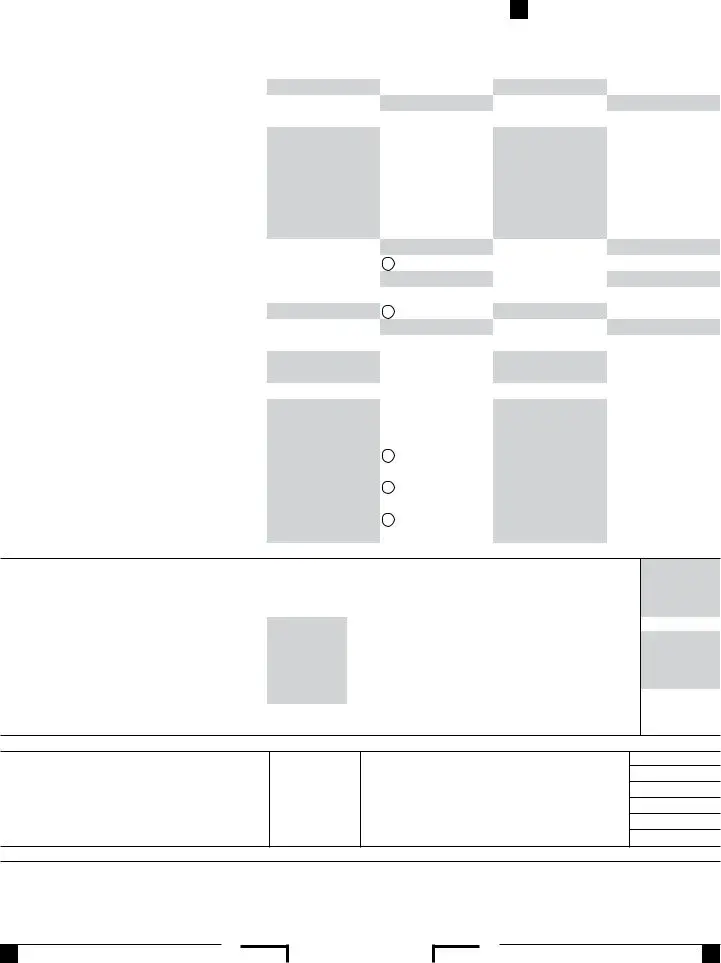

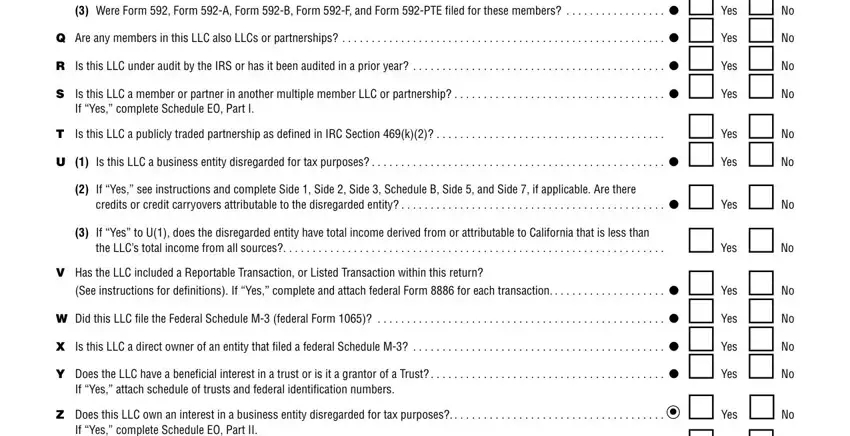

Fill out the file by looking at all of these areas: If Yes complete Schedule EO Part I, California Schedule K for each of, If Yes to U does the disregarded, If Yes see instructions and, V Has the LLC included a, If Yes attach schedule of trusts, and If Yes complete Schedule EO Part II.

Step 3: Choose the Done button to ensure that your finished document can be transferred to every gadget you decide on or forwarded to an email you specify.

Step 4: Make at least a couple of copies of the file to keep away from any upcoming challenges.